Introduction

In today’s fast-evolving digital landscape, financial institutions are prime targets for cyberattacks. Banks, insurance companies, and investment firms handle vast amounts of sensitive data, making cybersecurity services essential for protecting customer trust and regulatory compliance. As the threat environment grows more complex, many organizations are turning to Cybersecurity-as-a-Service (CSaaS) models to enhance their protection without overwhelming internal teams.

Choosing the right cybersecurity solutions is no longer just about firewalls and antivirus software — it’s about continuous monitoring, advanced analytics, and rapid response capabilities. This article compares top cybersecurity service providers and explains how IT security services companies are redefining how the financial sector defends against digital threats.

Understanding Cybersecurity-as-a-Service (CSaaS)

Cyber Security as a Service (CSaaS) delivers managed, cloud-based security that covers every layer of an organization’s digital environment — from endpoint protection to threat intelligence. Financial institutions benefit from scalable, subscription-based cybersecurity services that reduce capital expenditure while ensuring round-the-clock protection.

Modern cybersecurity service providers offer integrated platforms combining AI-driven analytics, intrusion detection systems, and data loss prevention tools. These capabilities are critical for banks and fintechs navigating strict compliance standards such as PCI DSS, GDPR, and ISO 27001.

Moreover, IT security services companies help institutions proactively identify vulnerabilities before they become costly breaches. Leading cybersecurity service providers often include automated incident response and real-time dashboards that provide deep visibility into security events.

The information security systems association continues to emphasize that financial organizations must adopt continuous monitoring and zero-trust frameworks — both of which are easier to implement through managed CSaaS offerings.

Comparing Leading CSaaS Providers for Financial Services

When comparing cybersecurity solutions for financial institutions, key factors include scalability, compliance readiness, and integration with existing systems. Below are three common types of cybersecurity financial services offerings:

Managed Detection and Response (MDR):

Leading cybersecurity service providers like CrowdStrike, Rapid7, and Arctic Wolf offer MDR. These cybersecurity service providers deliver 24/7 threat monitoring and rapid incident remediation. Financial institutions value MDR for its ability to reduce response times and prevent costly downtime.

Cloud Security as a Service:

As banks migrate workloads to the cloud, cybersecurity as a service offerings such as those from Palo Alto Networks and Check Point deliver centralized protection across hybrid and multi-cloud environments. These IT security services companies help secure customer data, APIs, and applications while meeting strict data sovereignty requirements.

Identity and Access Management (IAM):

Managing user access securely is essential in financial environments. Cyber security services providers like Okta and IBM offer IAM solutions that ensure only authorized users can access critical systems. This helps reduce insider threats and maintain compliance with audit standards.

Each cybersecurity service provider differentiates itself by its automation, AI-driven insights, and ability to adapt to an organization’s risk profile. Financial firms must evaluate whether a provider’s solution aligns with their operational goals and regulatory obligations.

The Information Security Systems Association recommends conducting periodic risk assessments and partnering with cybersecurity service providers that demonstrate a proven track record in handling high-stakes financial data.

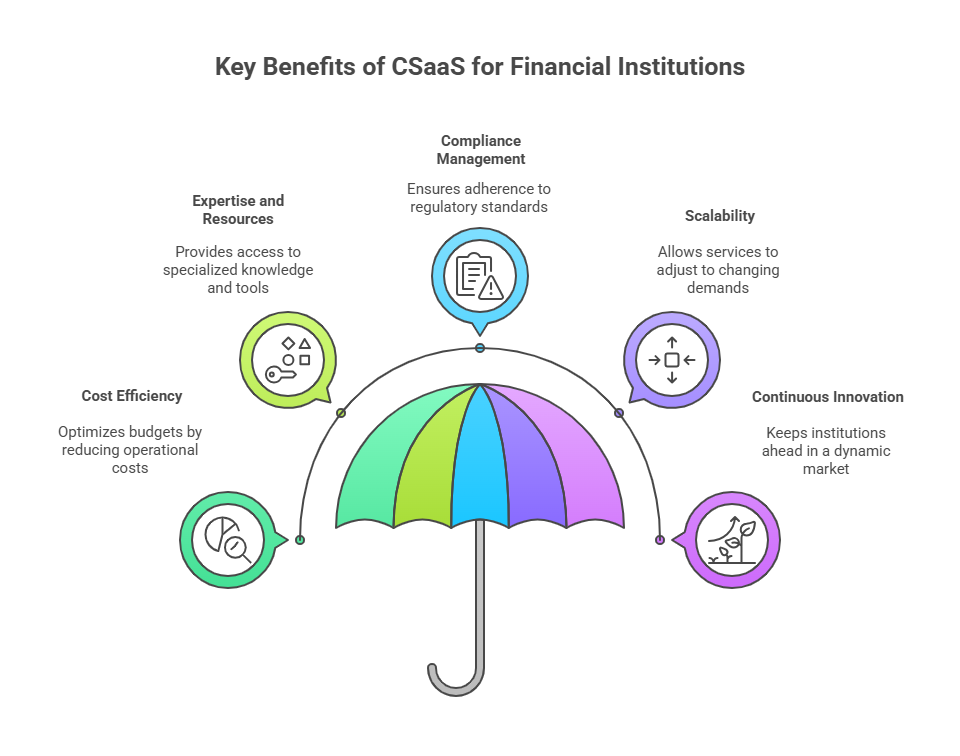

Key Benefits of CSaaS for Financial Institutions

Financial institutions choosing cyber security services through a CSaaS model gain several advantages:

Cost Efficiency: By outsourcing to trusted cybersecurity service providers, organizations convert large upfront investments into predictable operational costs.

Expertise and Resources: IT security services companies employ specialized experts who constantly monitor threats, keeping financial data secure around the clock.

Compliance Management: With the help of a cybersecurity services provider, financial organizations can more easily meet regional and global compliance standards.

Scalability: As business operations grow, cybersecurity as a service models scale seamlessly to cover new systems and users.

Continuous Innovation: Many cybersecurity service providers invest heavily in R&D to provide the latest defenses against emerging threats such as ransomware and AI-powered attacks.

Conclusion

In a world where cybercrime costs the global economy trillions annually, financial institutions cannot afford to rely solely on in-house solutions. Partnering with trusted cybersecurity service providers and adopting cybersecurity as service models ensures comprehensive, flexible, and cost-effective protection.

As the information security systems association and regulatory bodies worldwide continue to tighten standards, choosing the right cybersecurity services provider will determine an organization’s ability to stay secure and compliant. Financial institutions that strategically compare cyber security solutions and collaborate with reputable IT security services companies will be best positioned to protect assets, maintain customer trust, and lead in the era of digital finance.